When publicly-traded Class I freight railroad and intermodal service providers issued second quarter earnings results earlier this summer, the topic of less than ideal service on the rails was a common theme within the earnings releases and question and answer sessions with top management at those companies.

While much of the service issues stemmed from the harsh winter weather, service capabilities slowly remain on the mend, even though we are now closer to “next” winter rather than last winter.

“The one ongoing issue that persists from the winter is that we continue to experience substandard rail service…currently all rail on-time performance trails historical norms,” said Hub Group CEO Dave Yeager on his company’s second quarter earnings call.

Yeager pointed out that there are not any “quick fixes” for getting service back to ideal levels. He cited two areas that railroads are focusing on: increasing available resources and efficiency to route traffic, things which he said require hiring new crews, acquiring new locomotives where available and returning restored locomotives to service and accelerating increased in intermodal terminal capacity.

Other issues include a slowdown in train velocity and the ongoing challenges related to truck driver recruitment and retention, according to J.B. Hunt Transport Services Inc. President and CEO John Roberts.

The slower train velocity and ongoing service disruptions had a negative impact on train fluidity and resulted in a decrease in box turns and dray power utilization on an annual basis in the second quarter, Roberts explained.

Revitalized rail offers answers to complex logistics puzzle

Due to the driver shortage, highway congestion, lack of sufficient investment in highway infrastructure, and the current capacity crunch in trucking, savvy shippers are turning to rail with the help of their 3PL.

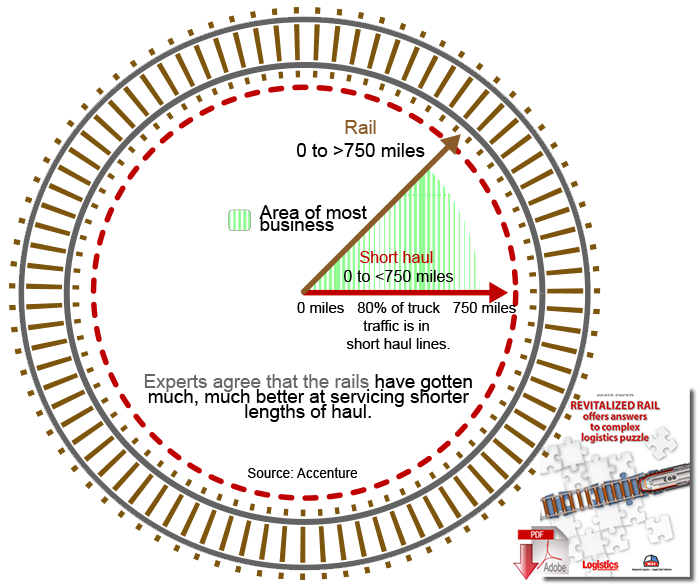

Experts agree that the railroads have gotten much, much better at servicing shorter lengths of haul. At the same time, truckers are being more selective in the freight they take - partially because the driver shortage is so acute.

“Truckers are getting more selective in the freight that they want, and rates are going up,” says WSI’s sales manager Steve Rusch. “In short haul, I would say rail is making inroads. It used to be 500 miles was absolute minimum to consider rail, but now you can see rail becoming any option in those under-500 mile lanes.”

According to Forecast, a collaboration between ATA and business analyst firm IHS Global Insight, overall freight tonnage will grow 23.5 percent from 2013 to 2025 and freight revenues will surge 72 percent.

From a railroad perspective, CSX COO Oscar Munoz noted on the company’s earnings call that even though there has been what he called a rapid surge in volume since the end of the first quarter, service levels have stabilized at a lower level and is not at the level shippers expect from CSX. And he added that CSX is seeing double-digit growth in the northern tier and conditions in the Chicago area remain challenging, too.

To address that, he said CSX is taking near-term actions to shift resources to those areas and also make infrastructure improvements and add crews and locomotives. Another focus area for improving intermodal service, he said, includes making changes on routing protocol to use other less congested hubs.

This year has been quite different than other in that all carriers and intermodal service providers have dealt with the same service issues to a certain extent. But the good news is that things are much improved since the end of the first quarter, according to Brooks Bentz, a partner in Accenture’s supply chain practice.

“Typically when clients tell us that they are dealing with capacity issues on the truckload side, we tell them to switch to intermodal as it has functionally unlimited capacity,” he said. “But at that time they could not make the switch to intermodal because of the problems in Chicago, drayage and network fluidity and while there was not sufficient network capacity at that time, now it has largely gone away.”

But, as the executives noted in their respective earnings calls, Bentz said there are still challenges in the intermodal network, with things slowly improving.

In terms of what is driving those improvements, he cited operating processes at terminals, improved technology and reservations and intake and outtake systems.

“These things are all getting way better; there is not the gigantic queue of trucks waiting to get into a gate like in the past, or at least not as much,” he said. “Process improvement has just been huge.”

In light of the aftereffect of intermodal service issues in 2014, Bentz said it is imperative for shippers to plan ahead when using intermodal. One of the main reasons for that, he said, is that intermodal is not a “day of” type of thing, because shippers cannot get access to a trailer in the same way they can access a domestic container.

Instead, they need to be thinking well ahead of when they want to turn to intermodal from a rates, capacity, and services perspective.

“They also need to consider if they need to lease equipment and boxes or get them from another provider,” he said. “They should be talking to service providers looking for business rather than those who can only do them a favor. “There is a planning exercise you need to go through. It is looking at your overall network and freight flows and how best to serve it and determine what part of your freight mix should go intermodal and what part should go via truck. Is it static with Chicago to Los Angeles always going intermodal or should they use intermodal Wednesday to Friday only, due to Monday deliveries? There are different dynamics that require shippers to look at their networks systemically.”

While planning accordingly is key, especially in light of current service conditions, Larry Gross, senior consultant at FTR, said looking at service metrics, like train speed and yard dwell times for car loads for various major classifications, is very helpful.

“There are really two things to watch,” he explained. “One is how long cars are sitting in the yard before they are on the next train, and how fast they are running. We saw a big increase in yard dwell time and a big decrease in train speeds [earlier this year]. It was aggravated by the winter, but there were signs of problems prior to that. Since then, railroads have put resources towards remedying this to get out of the hole as so much volume was coming in that is critical to them.”

Even with the ongoing, but slowly improving intermodal service challenges, volume trends are solid overall.

The Association of American Railroads reported that for the first 34 weeks of 2014, total intermodal traffic is up 5.7 percent annually at 8,730,830 containers and trailers. And the Intermodal Association of North America’s data indicates that through July total intermodal movements, at 9,366,426, are up 5.8 percent annually.

Despite these solid numbers, FTR’s Gross stressed that service is and will remain the big story.

“Everywhere shippers turn to they are facing capacity issues, cost issues, and service problems,” he said. “The ports are dealing with it, too, and things are impaired on that side.

It is not a problem that gets fixed very easily, due to the chassis situation, which is in the mid-to-late stages of a transition where ocean carriers are exiting the supply side of the business and other entities are now supplying the chassis, which comes with labor and jurisdictional issues.

Dock workers had traditionally maintained the chassis, but they are now being supplied by people that are not necessarily on the dock, which has led to issues with having the chassis in the right place at the right time and can make things difficult.”

Article topics