The past year was a good one for sellers of battery monitoring solutions of all kinds, which isn’t terribly surprising. In the wake of broad telematics adoption, a sharper focus on batteries is the logical next step. Telematics and detailed fleet management often followed a crawl-walk-run pattern from simple impact monitoring, to utilization tracking, to operator accountability. Solution providers and their users learned a lot about how to bring data together, how much is too much, and what to do with the information. Getting control of batteries is a similar journey with many of the same lessons, as fleet managers work to establish the same granular visibility into battery assets.

For most, the addition of any visibility is a start. Batteries are chronically mismanaged, a legacy stemming from the perception that lift trucks are a necessary evil, a means to the more important end of getting product out the door. Lean thinking has helped streamline the movement and usage of resources from labor to raw materials to operational data. However, many lift truck fleets still burn through power with reckless abandon.

“Nobody ever got fired for having more batteries than they needed,” says Harold Vanasse, vice president of sales and marketing for Philadelphia Scientific. “If I were a battery manager, I don’t ever want to say to the boss, ‘well, we didn’t move enough product, but I saved you money on batteries.’ When they get visibility into the battery room, however, there is amazement at what they can see that they never saw before. Is it any different than the visibility you’re getting from some of your more expensive operations and assets? No. The battery room is just one of the last areas of innovation in the warehouse ecosystem.”

Digging into the details

To get the same sort of control and efficiency, some begin with the crawl, like simple blinking lights indicating battery water level. Others go straight to the run, gathering detailed battery data and overlaying it with telematics, labor management and even warehouse management systems to build a precise view of operations. Whatever the level of sophistication, the exploration process will likely reveal some surprises.

“Batteries were always just assumed to be an expense, and very few efforts were made to dive in and see what efficiencies can be gained,” says Lynda Stephens, director of information solutions at EnerSys. “To be fair, the technology just wasn’t really there until recently. The accuracy with which we can collect data is much better. Remember, batteries are electrochemical boxes, and it’s important you measure the right things with the right accuracy.”

For example, a single drop of condensation on an old water monitor could give a false reading of sufficient water levels. But even if the gauge is perfectly precise, the real challenge is determining the root cause of why, for instance, a battery was over-discharged. A blinking light is not meaningful input for process improvement. To correlate data sets, determine root causes and solve problems, Stephens says, is a challenge even with all the data in the world.

“We’ve learned that it’s not only about putting a device on, collecting data and presenting it,” she says. “That’s just the beginning. There’s an idea that you can manage by exception only, but that’s not how you save hundreds of thousands of dollars. There’s a bigger picture analysis from an efficiency perspective.”

According to Jeff Harrison, business manager for Ametek Prestolite Power, that big picture is clear to only about 20% of battery owners who use data collection to intelligently manage their fleets. The remaining 80% have not yet adopted the technology—or have not yet used it to its fullest potential. He emphasizes partnership between the customer and solution provider as the only sure path to success.

According to Jeff Harrison, business manager for Ametek Prestolite Power, that big picture is clear to only about 20% of battery owners who use data collection to intelligently manage their fleets. The remaining 80% have not yet adopted the technology—or have not yet used it to its fullest potential. He emphasizes partnership between the customer and solution provider as the only sure path to success.

“Too many times we see customers who don’t want to be involved in the process, but they need some ownership,” Harrison says. “They need to hold their own people accountable, set some simple metrics and make sure they’re followed. Are you empowering your dealer or partner, or are you handing them data and calling it done? Do you use that data to manage your fleet? So many are spending money and not maximizing their return.”

Vanasse says customers often have one of two management approaches, when a blend of the two is ideal.

“The first is a sort of ‘GPS’ mentality. They turn on the device, get a set of directions, follow the steps and hopefully get where they want to go,” Vanasse says. “There is certainly a low-hanging return on investment to that approach.”

Vanasse offers the example of a customer’s large distribution center that had been making 115,340 battery changes each year before using a battery management system to cut that to 85,045. The cost per change was reduced from $4.52 before proper management to $3.55 after, and the customer saved a total of $194,728.

“The second layer is more managerial and has to do with data,” Vanasse says. “Is my spend good or bad? Do I need more assets? Fewer? How are my people performing with these assets? This goes far beyond step-by-step guidance.”

The same customer used the data to inform decision-making and over the course of two years reduced the number of pallet jack batteries from 544 to 380 and the number of forklift batteries from 194 to 153—even as the number of cases picked per day slightly increased. Prior to the battery management system, the DC was running 2.7 batteries per truck, which was reduced to 1.8 and saved more than $650,000.

You nearly always have an opportunity to reduce the number of batteries in use, Vanasse says. In one striking example that has since become a sort of pattern, a customer anticipated a spike in business after a hurricane hit the east coast. Their instinct, he says, was that the battery room would be under-capacity, and worse yet, they would need to run more electrical infrastructure into the building.

“But when you look at the statistics on charger usage in the United States, they’re used about 22% of the time, when the theoretical maximum is 66%,” he explains. “You don’t need more chargers; you need access to the unused time of the chargers you have.”

Detailed battery monitoring can expose true charger utilization, which is often closer to 20% than the theoretical 66% maximum.

Battery management systems enable charger sequencing. They will tell the operator which fully charged, which fully cooled battery to select, but it can also tell when to switch batteries. For example, two batteries can be charged by the same charger, one after another, so when the first charge is complete a nearby operator can manually swap connectors to get more utilization out of the charger.

Identifying an opportunity

Once batteries are well-managed, the fleet right-sized and plenty of historical data available, it might be time to consider opportunity charging. Instead of a central battery room and the need for more than one battery per lift truck, opportunity charging allows for decentralized charge stations and can increase productivity and efficiency in

the right application.

John Rosenberger, director of iWarehouse Gateway and global telematics for The Raymond Corp., notes a marked increase in the number of customers who pursue opportunity charging. Although it isn’t for every application, just about anyone who sees the value of eliminating mid-shift battery swaps could benefit from the technology. The ROI is lower for smaller fleets, but above 20 units the payback scales up rapidly, he says.

“In light of the interest in opportunity charging, people are becoming more aware they need to monitor batteries and energy consumption, as well as how they’re being used throughout the day,” Rosenberger says. “The questions become: Is charging during 15-minute breaks and lunch enough? Do you have to set up plugs in one or more corral areas? The logistics and energy monitoring change when you go to opportunity charging.”

Identify battery management process issues

EnerSys’ Lynda Stephens says battery management process issues primarily come from four places.

- Operators who do not follow protocol. A particularly malicious example is the act of unplugging and reconnecting a battery that is on the verge of over-discharging, which can give an operator a few extra minutes while potentially reducing the life of the battery by much more.

- The asset itself, where Stephens says much of the focus can be well-meaning but ineffectual. The problem is that collecting information from a sensor or a charger only captures one moment in time, she says. This tells you about the specific gravity, the temperature, etc., but it doesn’t tell you about the battery when it’s under load. The root cause of an issue might not be in the battery but the lift truck, which could be tuned to work the battery much too hard and might need a motor adjusted.

- Maintenance practices, which can also give the appearance of discipline while actually producing waste. Equalization, watering and other intervals must be set properly. Too often, and you waste labor. Too infrequently, and you damage the battery, decrease its life and sap productivity.

- Decision-making, which is not just whether a battery needs to be replaced. Customers often complain about annually budgeting for batteries. Anecdotal data that battery No. 8 has a problem is not sufficient to justify an investment in more batteries. Good data is also necessary to know if alternatives like lithium-ion batteries, hydrogen fuel cell or fast-charging technologies will produce returns in a given application.

The notion of spreading the battery room environment—and the potential for an acid spill—to several areas within the facility is unappealing, which is why modern smart charger technology prevents the over-cooking of batteries that leads to spills. Rosenberger says they could also slightly shorten the battery’s life, since they will rarely go through the full charge/discharge cycle if they’re constantly being topped off.

“But they’ll always be full,” he says. “If you plan correctly, then even if there’s a busy time, higher racks or heavier loads, you will never run out of power. The planning is critical. Many, many customers talk about opportunity, but they’re running blind if they make that shift without first using a battery monitoring product to collect data and make the case.”

Usage will vary by department and task, so battery data can quantify that high bay putaway used X energy, while the dock consumed Y. Based on that data and projections, Rosenberger says, it’s possible to say with certainty whether equipment has the right size batteries. This can save money if a smaller battery will do the trick, and can prevent being caught off-guard if more power is needed.

“If you know next year you will have another 300 SKUs of pallets greater than 5,000 pounds, you can start looking for a more efficient truck next year and make sure you have the right voltage. If you’re opportunity charging, you will also have to charge them more. You can’t improve what you don’t measure, and technology today makes it easier to manage.”

Companies mentioned in this article:

View Batteries Related Products and Accessories

NexSys line of batteries

NexSys line of batteries

Fast charge batteries in less than an hour.

PowerPulse battery maintenance system

PowerPulse battery maintenance system

Maximize single, multiple battery bank charging.

GenDrive 2000 series hydrogen fuel cell systems

GenDrive 2000 series hydrogen fuel cell systems

Hydrogen fuel cell offers increased fuel storage and 56% longer runtime.

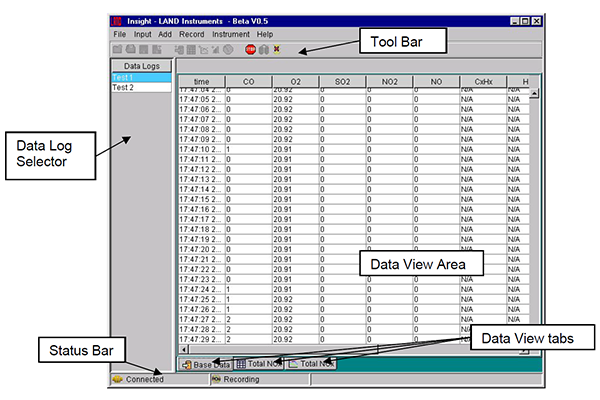

Insight data acquisition & analysis software

Insight data acquisition & analysis software

Gain battery performance insight with software.

PowerTrac DT battery diagnostics tool

PowerTrac DT battery diagnostics tool

Monitor battery performance for better operating efficiency.

FlexPAK battery/charger combo pack

FlexPAK battery/charger combo pack

Eliminate routine maintenance with batteries that do not require watering.

Article topics